In industrial production, the trend of implementing industrial robots is becoming more and more common wherever high repeatability, quality, and efficiency are required, as it translates into increased productivity and a significant reduction in costs.

Robotization in the world

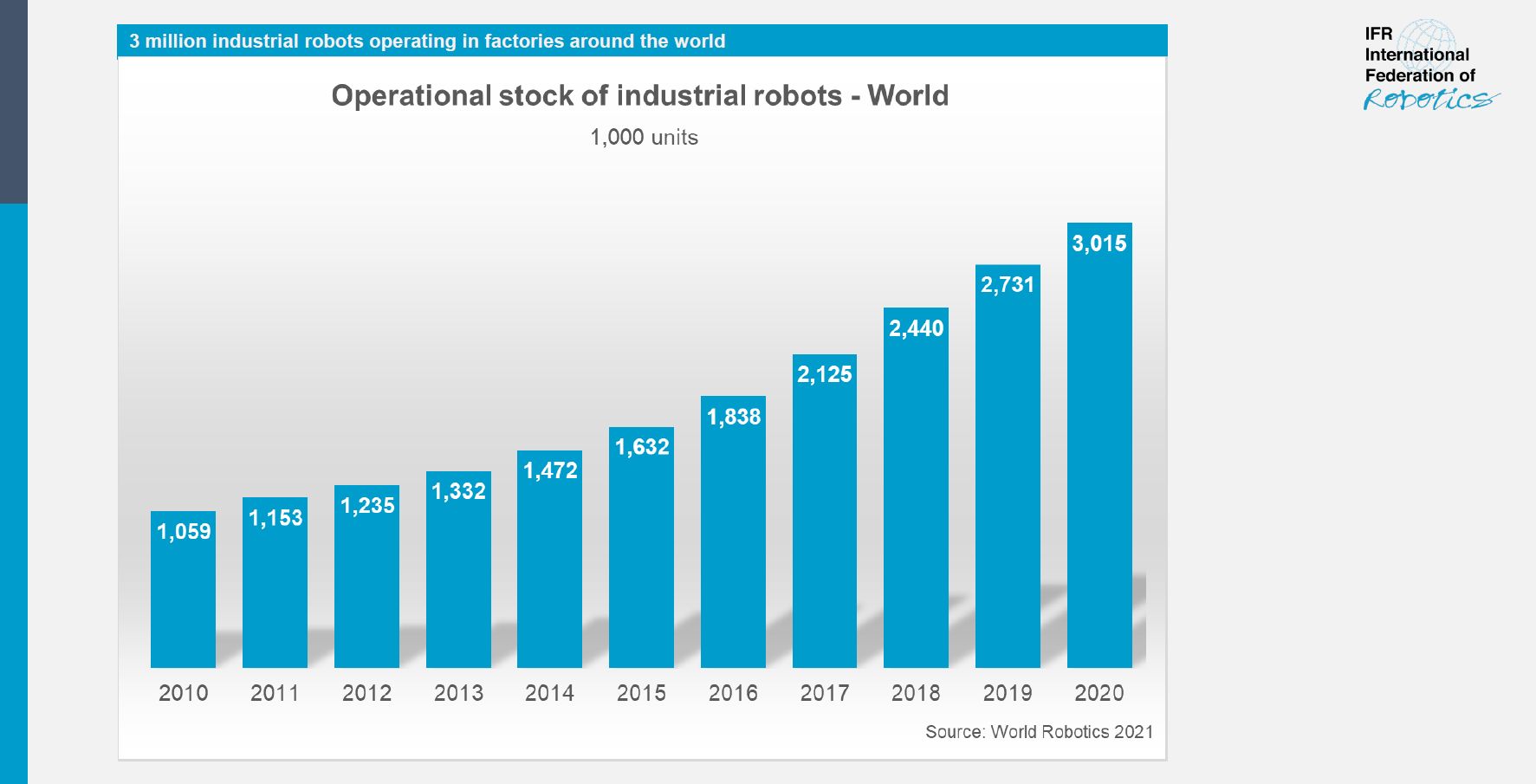

This is confirmed by the results of the World Robotics 2020 report published in November by the International Robotics Federation. Despite the pandemic, there is an upward trend (+ 10%) expressed in the number of robots operating in the world - there are currently over 3 million of them. The robotization density index is currently 126 (per 10,000 employees) - in 2018 this index was 99. This result was largely influenced by Asian markets, where 71% of all new robots were implemented, of which as much as 20% were in China.

Fig. 1.The total number of robots working in the world - 1000 units

In Europe, where there were the fewest implementations compared to the rest of the world, most installations took place in Germany, Italy, and France. The upward trend is also visible in Poland (despite a slight decrease in 2020) and Central and Eastern Europe, where, despite the initial slowdown caused by the pandemic, there is a growing interest in the automation and robotization of processes. This is due to, inter alia, the declining number of blue-collar workers, the outflow of skilled workers to Western markets, rising labor costs, and unfavorable demographic changes (fewer and fewer people of working age).

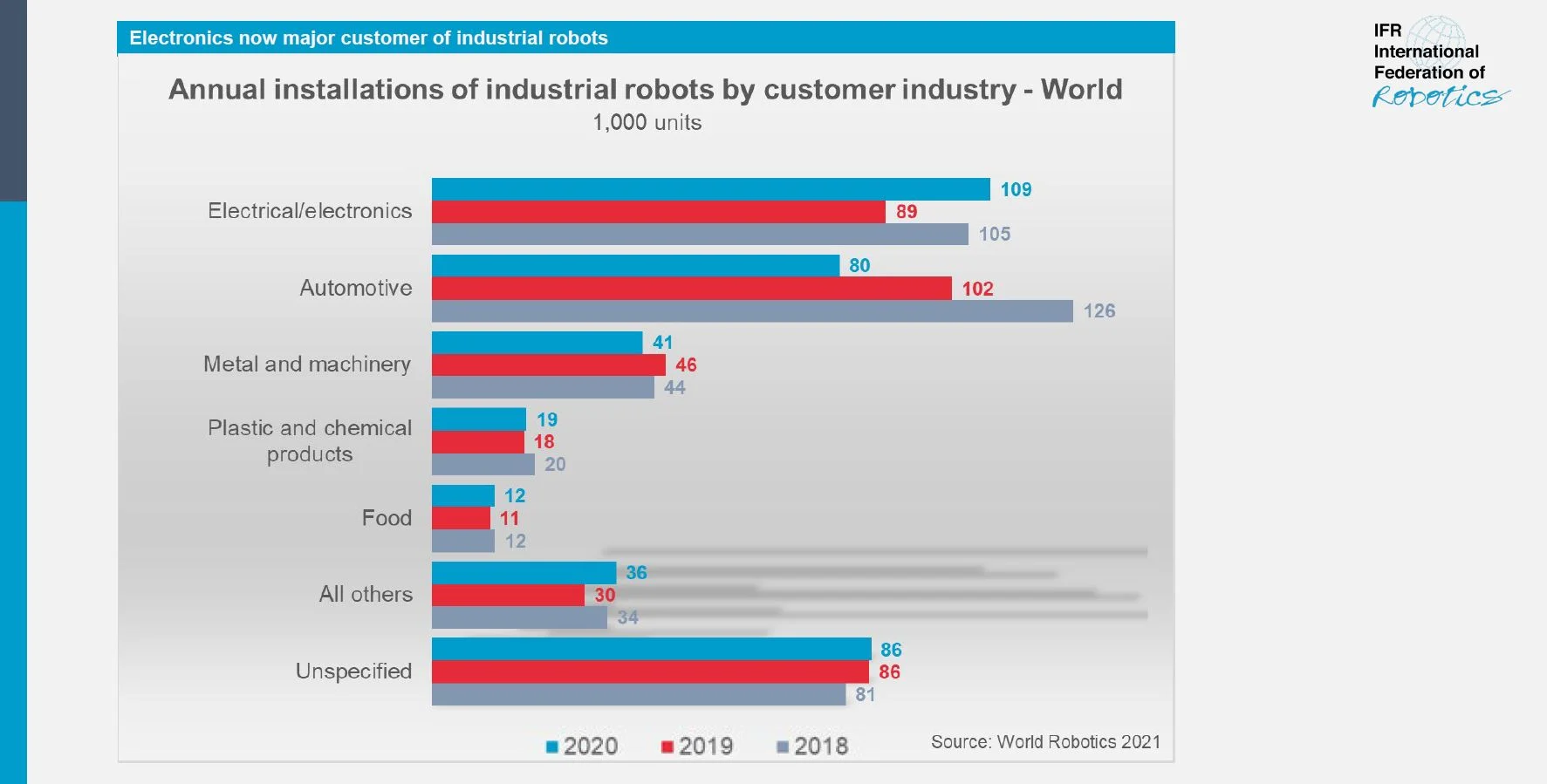

Fig. 2. Annual installations of industrial robots by customer industry - World - 1000 units

There is also a growing interest in robotization in small and medium-sized enterprises that have problems with maintaining production continuity due to the human factor. This is confirmed by the data in the report, which shows a change in the proportions of implementations in industries - a decline in the previously dominant automotive industry and growth in other sectors, especially electrical, electronic, metal and machine production. IFR expects growth of 13% over the next five years.

Boom on the service robots market

The results of the World Robotics 2021 - Service Robots report are even more interesting, includingAMR mobile robots and AGV carts.In 2020, the market of robots for professional services achieved a worldwide turnover of USD 6.7 billion, thus recording an increase of 12%.

This dynamic growth was undoubtedly influenced by the coronavirus pandemic, which can be seen in the five most important trends in the use of professional service robots:

- AMR and delivery robots - the need for flexible solutions;

- cleaning and disinfection - +50 companies presented solutions in response to the pandemic;

- medical and rehabilitation - the need for individual support;

- social robots - telepresence - in particular, due to the pandemic;

- automatic restaurants - service support, reduction of personal contacts due to the pandemic.

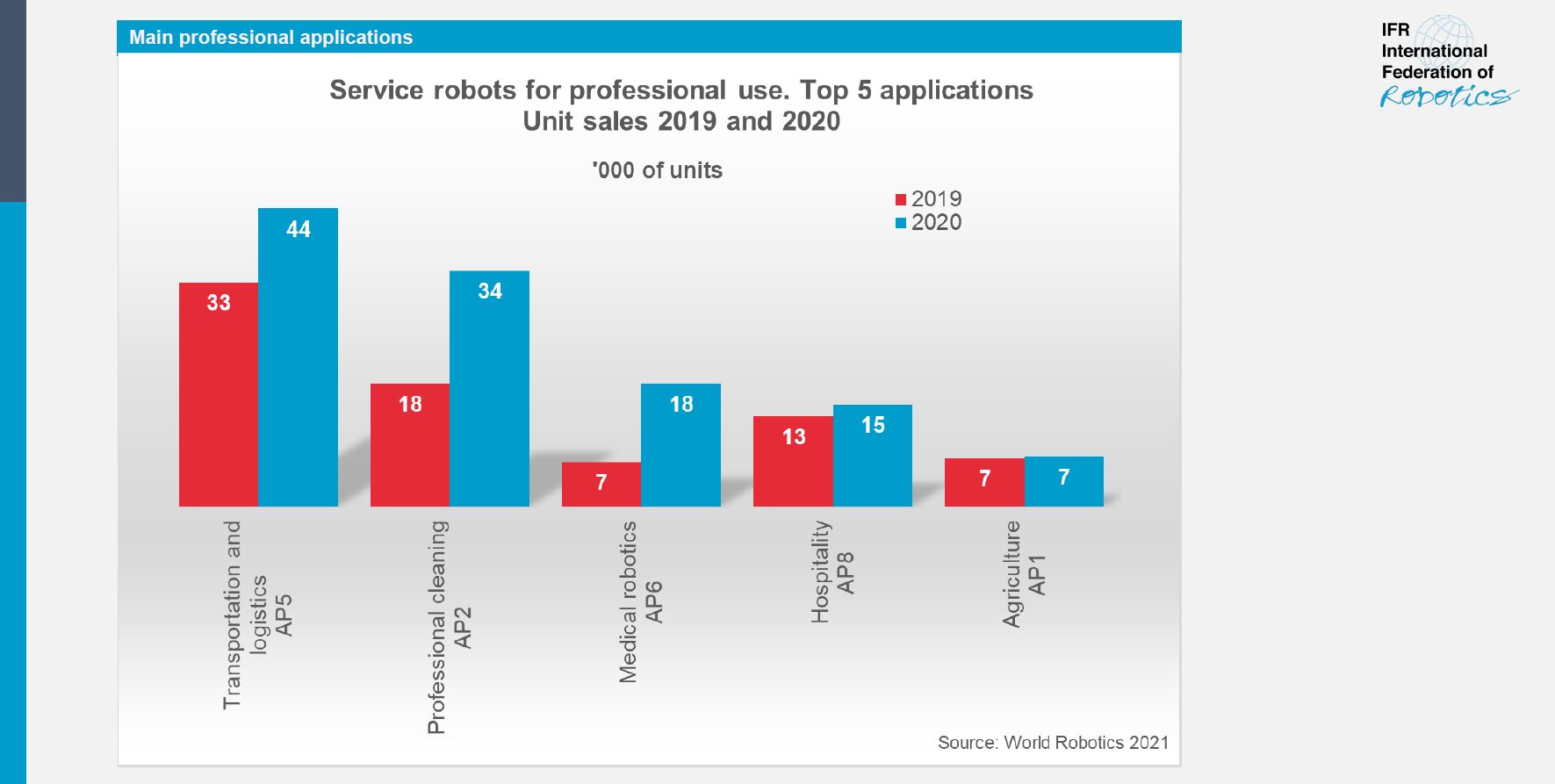

Fig. 3.Service robots for professional use.Top 5 applications.Unit sales 2019 and 2020

It is worth noting that as many as one in three units was built for the transport of goods or cargo. According to IFR, most of the autonomous mobile robot units sold operate in indoor environments for production and warehouses. The trend is towards flexible solutions so that AMR works together in mixed environments, incl. with the help of forklifts, other mobile robots, or people.

This is also confirmed by the inquiries and implementations of MOBOT® mobile robots, which more and more often work in a very dynamic environment, transporting loads in communication routes, where forklifts and people are also present.

There is also a great market potential for transport robots in outdoor environments and public traffic, incl. last-mile delivery. However, further development in this area will be largely influenced by legal regulations in individual countries, which currently prevent it from happening.

A large increase, by as much as 92%, was also recorded in the case of cleaning robots, 34,400 of which were sold. In response to the growing hygiene requirements caused by the Covid-19 pandemic, more than 50 service robot suppliers have developed robots to disinfect, spray disinfectants or use ultraviolet light.

Fig.4.ALVO® Ultra V-bot - mobile robot for UV-C disinfection

These solutions include, among others ALVO® Ultra V-bot developed by ALVO® Medical, in cooperation with technological partners: WObit and Luxiona. The mobile UV-C disinfection robot ensures high efficiency of decontamination in all important public spaces: concert halls, schools, production plants, sports clubs, shopping centers, laboratories, etc.

The IFR indicates that disinfecting robots in hospitals and other public places has great potential. Unit sales of professional cleaning robots are expected to grow on average at double-digit rates each year from 2021 to 2024.

The global Sars-CoV-2 pandemic has created an additional demand for social robots.The need for their implementation is especially high in nursing homes, where they serve residents to keep in touch with friends and family members in times of social distancing.In public places, robots perform an information and communication function by providing information to avoid personal contact of people, and also connecting people via video at business conferences or assisting with maintenance tasks in production halls.

The demand for hotel works has also increased, providing, inter alia, food or bedding for rooms - turnover in this industry amounted to USD 249 million. Double-digit annual growth in this regard is projected.

The upward trend also applies to service robots for consumer use, among which the most popular are domestic robots (vacuum cleaners and other robots for cleaning floors). In 2020, nearly 18.5 million units were sold (+ 6%), with a value of USD 4.3 billion. This is due to, inter alia, the very high availability of these solutions. Gardening robots, especially mowing lawns, are also popular. It is expected that in the coming years, the market of consumer service robots will have an average double-digit growth dynamics each year.

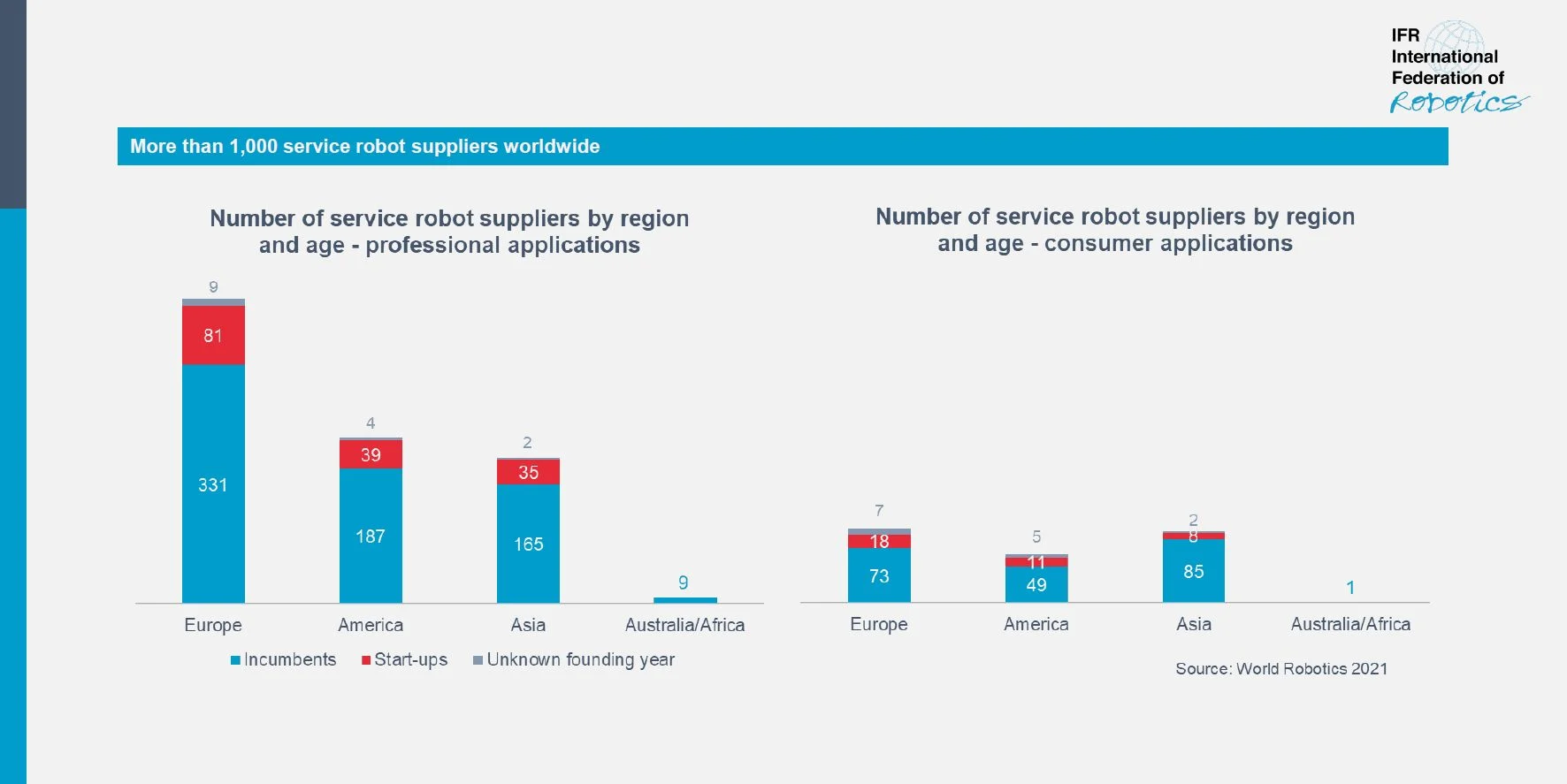

Fig.5. Left - Number of service robot suppliers by region and market experience - professional applications Right - Number of service robot vendors by region and market experience - consumer applications

Interestingly, 80% of service robot suppliers have been in the market for more than 5 years, of which 47% are from Europe, 27% from North America, and 25% from Asia.

The autonomous vehicle robotics market is growing

The dynamic growth of the autonomous mobile robots market is also confirmed by the latest Autonomous Mobile Robots Market report published by Verified Market Research. In this study, the AMR robot market was valued at $ 2.1 billion in 2020 and is expected to reach $ 8.7 billion in 2028, with an annual growth of 18.7%.

Among the driving factors for the market presented in the report is the growing use of robots in various industrial sectors, technological progress, the growing area of autonomous vehicle applications, and the increasing awareness of the benefits of autonomous robots. They are machines designed to perform certain actions and behaviors. Using autonomous navigation and other functionalities, AMR robots perform tasks without human assistance (artificial intelligence), they are easy to adapt to new tasks, they are also safe for people, property, and the environment.

Thanks to these features, mobile robots are a very flexible solution for the implementation of tasks in various industries. The Verified Market Research report highlights, in particular, the development of IoT in the automotive industry, as well as the expectation from users accustomed to the digital lifestyle that it will be transferred to the car with the help of the Internet of Things technology.

Summary and perspectives

The common denominator of all the studies presented above is the worldwide popularization of robotization, observed by researchers, especially in the market of service robots. It results, as indicated earlier, from the need to improve processes, reduce manufacturing costs, and increase production efficiency. The need to invest in robotization was also influenced by the Covid-19 pandemic, which caused an increasing shortage of skilled workers and instability in maintaining continuity of production due to the human factor. All reports consistently forecast an increase in investments in robotization in the coming years, which will not be shaken by even temporary shortages of components and raw materials.

Are you interested in the article? Do you want to learn more about mobile robots and how they can improve processes in your company? Do not hesitate and contact our advisor.

Sources:

https://ifr.org/ifr-press-releases/news/robot-sales-rise-again

https://ifr.org/ifr-press-releases/news/service-robots-hit-double-digit-growth-worldwide

https://www.verifiedmarketresearch.com/product/autonomous-mobile-robot-market/

See our products

MOBOT® TRANSPORTER T5 mobile robot

MOBOT® TRANSPORTER T5 mobile robot MOBOT® AGV eRunner 003 mobile robot

MOBOT® AGV eRunner 003 mobile robot MOBOT® AGV FlatRunner MW HT mobile robot

MOBOT® AGV FlatRunner MW HT mobile robot MOBOT® TRANSPORTER T15 mobile robot

MOBOT® TRANSPORTER T15 mobile robot MOBOT® AGV CubeRunner2 004 mobile robot

MOBOT® AGV CubeRunner2 004 mobile robot MOBOT® TRANSPORTER mobile robot

MOBOT® TRANSPORTER mobile robot Industrial mobile robot MOBOT® AGV FlatRunner MW

Industrial mobile robot MOBOT® AGV FlatRunner MW Mobile robot MOBOT AGV eRunner MW

Mobile robot MOBOT AGV eRunner MW MOBOT® AGV FlatRunner HT 004 mobile robot

MOBOT® AGV FlatRunner HT 004 mobile robot Mobile robot MOBOT® AGV FlatRunner MW Light

Mobile robot MOBOT® AGV FlatRunner MW Light MOBOT® AGV CubeRunner MW mobile robot

MOBOT® AGV CubeRunner MW mobile robot