With the new year 2021, entrepreneurs will have a new opportunity to obtain a return on investment in automation and robotization. The draft tax relief prepared by the Ministry of Finance and the Ministry of Development is an opportunity to improve the efficiency and quality of production of Polish enterprises.

Many companies are struggling with a labor shortage and the resulting problems with order fulfillment. At the same time, Poland is in the tail of European countries in terms of the level of robotization and automation with the rate of 42 robots per 10,000 employees. It is a gulf in the pursuit of world leaders such as Singapore (918 robots) or South Korea (855 robots). We are also quite distant from our neighbors, according to the Polish Economic Institute, in Germany the robotization index is 346, and in Slovakia 169 robots are employed per 10,000 employees.

Investments in new technologies will contribute to the modernization of industrial production, increase efficiency, improve quality, and reduce costs. The implementation of robots will relieve employees, increasing the comfort and safety of their work, and will also allow companies to operate faster and more flexibly in a changing and uncertain reality. As a result, it will increase the competitiveness of Polish enterprises in the international arena and facilitate export expansion.

|  |

Entrepreneurs will be able to additionally deduct 50% of the costs incurred for investment in robotization, regardless of the size and type of industry.

Who will be able to take advantage of the robotization tax relief?

The regulations under preparation assume that large companies as well as small and medium-sized enterprises will be able to take advantage of the relief. Both PIT and CIT payers will be able to deduct costs for robotization during the tax year, and at the time of submitting the annual tax return, they will make an additional write-off (similar to the relief for research and development works).

What costs will be subject to the robotization relief?

The deduction from the tax base of 50% of eligible costs related to investments in robotization is to apply to:

- purchase or leasing of new robots and cobots,

- software purchase,

- purchase of accessories (e.g. running tracks, rotators, controllers, motion sensors, end effectors),

- purchase of occupational safety and health (OHS) equipment,

- training for employees who will operate the new equipment.

Discount for robotization as part of the relief ecosystem together with R&D and IP Box

The above catalog has been prepared based on the experience of research and development relief. An amendment has been in force since 2018, increasing the possibilities of support for entrepreneurs by extending the type of deductible expenses and the amount of the deductible.

According to the Ministry of Finance, more and more companies are taking advantage of the R&D relief. In 2019, more than 3,700 taxpayers benefited from the R&D relief, an increase of 34 percent compared to the previous year. From 2019, the IP Box tax relief is also available, allowing entrepreneurs to use the preferential 5% tax rate to commercialize intellectual property (IP) rights obtained from their own research and development activities.

From when and how long will the robotization relief apply?

Currently, the final work on the draft is underway, which is to be debated by the Sejm this autumn. The new regulations are to enter into force at the beginning of 2021 and apply for the next five years, i.e. until December 31, 2025. That is why it is worth planning new projects and investments today in order to make the most of the robotization tax relief.

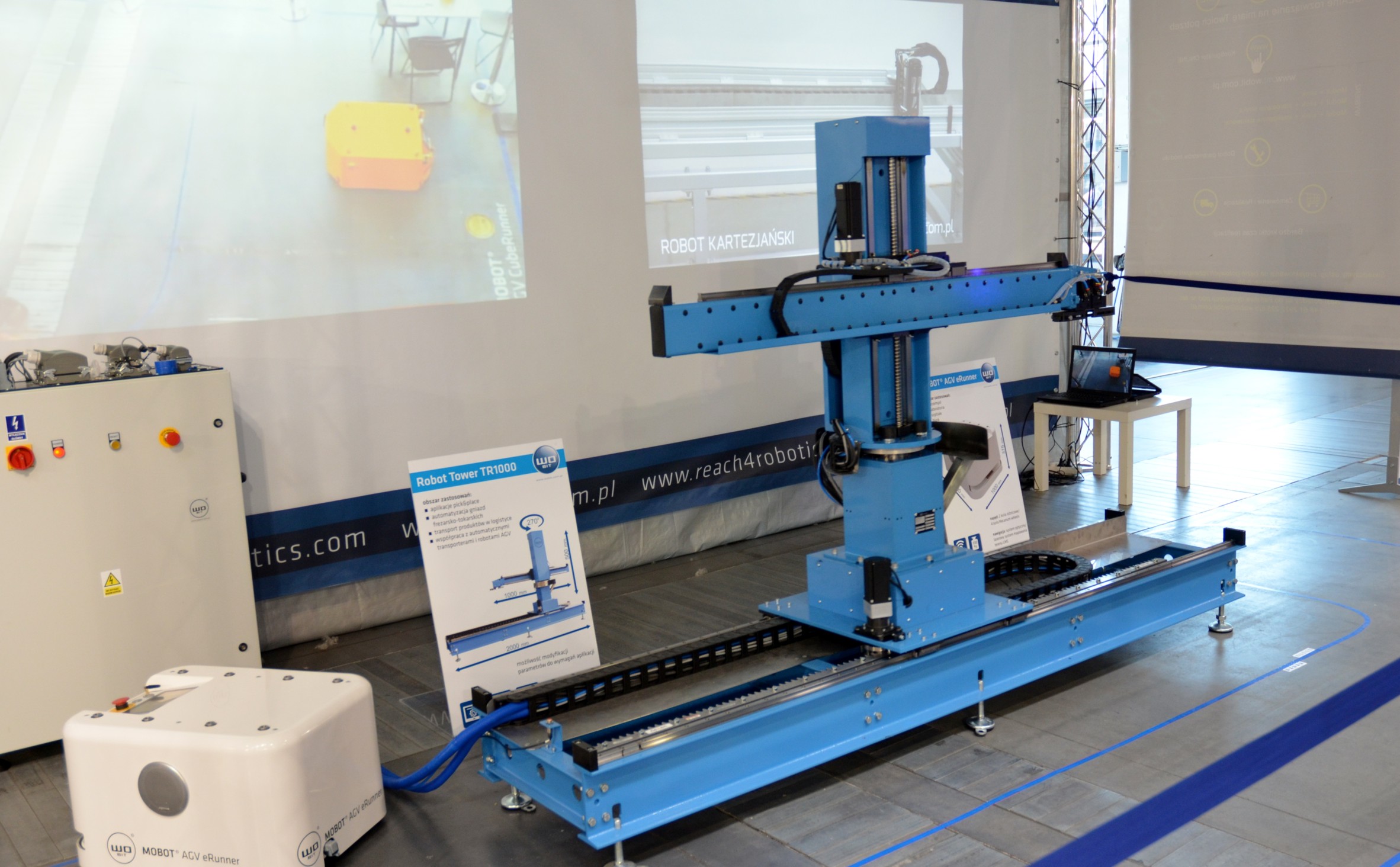

We invite you to talk about robotization and automation of production processes with our experts. ZAsk if robotization will work in your company and where to start modernization. Find out which solution will be optimal for your application. Take advantage of the experience and knowledge of a Polish manufacturer of industrial robots, including MOBOT® autonomous mobile robots and Cartesian systems.

See our products

Industrial mobile robot MOBOT® AGV FlatRunner MW

Industrial mobile robot MOBOT® AGV FlatRunner MW MOBOT® TRANSPORTER T5 mobile robot

MOBOT® TRANSPORTER T5 mobile robot Mobile robot MOBOT® AGV FlatRunner MW Light

Mobile robot MOBOT® AGV FlatRunner MW Light MOBOT® TRANSPORTER T15 mobile robot

MOBOT® TRANSPORTER T15 mobile robot MOBOT® AGV FlatRunner HT 004 mobile robot

MOBOT® AGV FlatRunner HT 004 mobile robot MOBOT® AGV eRunner 003 mobile robot

MOBOT® AGV eRunner 003 mobile robot MOBOT® AGV CubeRunner MW mobile robot

MOBOT® AGV CubeRunner MW mobile robot Mobile robot MOBOT AGV eRunner MW

Mobile robot MOBOT AGV eRunner MW MOBOT® AGV CubeRunner2 004 mobile robot

MOBOT® AGV CubeRunner2 004 mobile robot MOBOT® TRANSPORTER mobile robot

MOBOT® TRANSPORTER mobile robot MOBOT® AGV FlatRunner MW HT mobile robot

MOBOT® AGV FlatRunner MW HT mobile robot