The hearts of young children increasingly require specialist cardiac surgery due to their profound failure. They suffer from both congenital and acquired defects. Sometimes a heart transplant is the only salvation, but before that happens, the heart must be relieved by a mechanical device that pumps the blood.

This is achieved by prostheses created, among others by the Foundation for the Development of Cardiac Surgery Zbigniew Religa. The Foundation is currently working on the development of a family of Polish heart prostheses under the ReligaHeart® brand, which will include:

- ReligaHeart®EXT - extracorporeal pulsatile heart prosthesis for adults

ReligaHeart®PED - extracorporeal, pulsed prosthesis for children

ReligaHeart®ROT - implantable vortex heart prosthesis

By donating 1% of your tax, you will help achieve this goal and give patients a chance!

We encourage you to donate 1% of your tax to the Foundation for the Development of Cardiac Surgery. prof. Zbigniew Religa KRS 0000069136

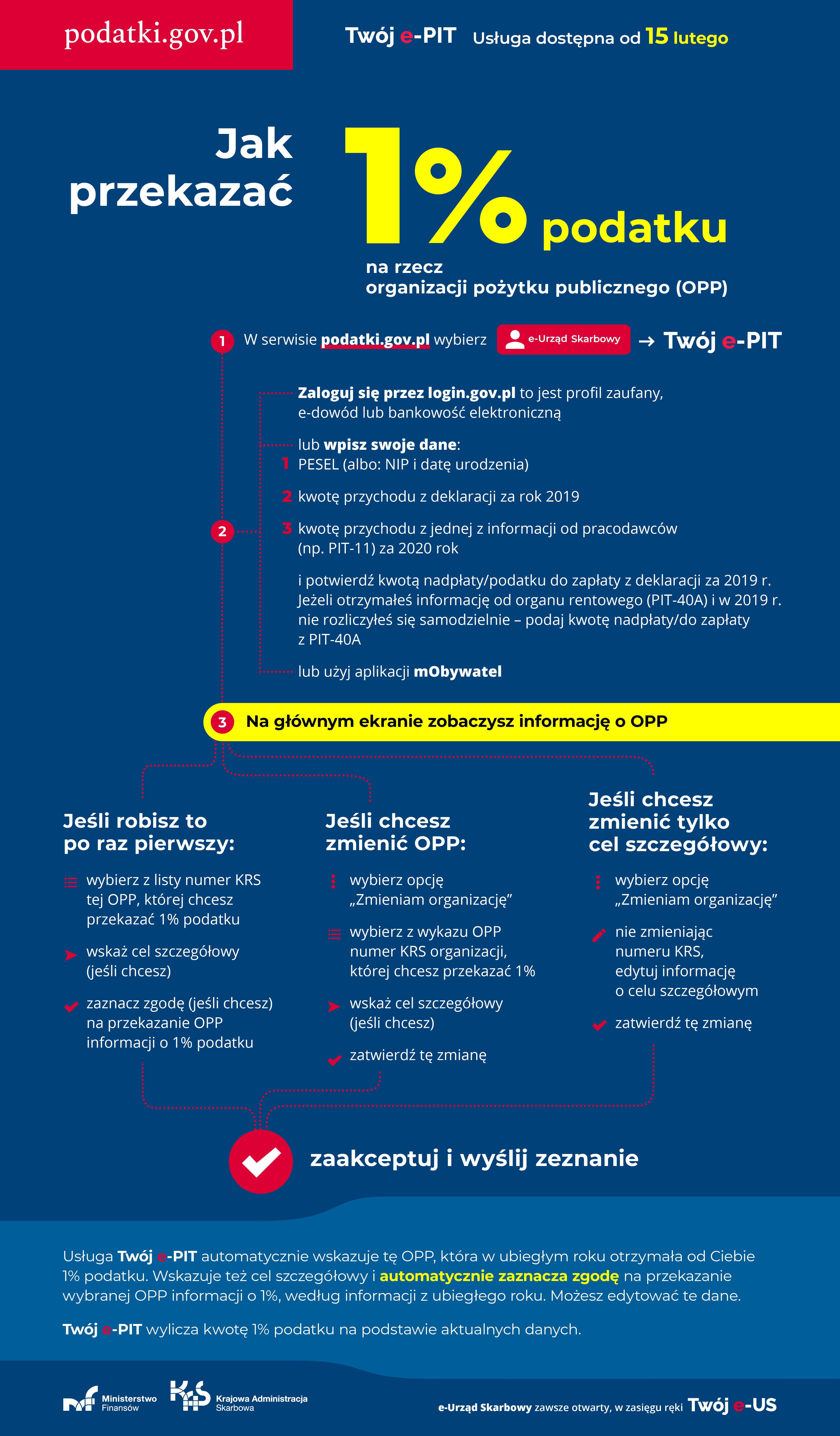

How can 1% of tax be donated??

Free PIT program

Below we present a program that will facilitate the donation of 1% of tax to the Foundation for the Development of Cardiac Zbigniew Religa:

Who can donate 1%?

The right to transfer 1% of tax applies to all taxpayers who settle in a given year taxable income that is not exempt from tax. Therefore, it can be settled by taxpayers settling accounts:

- employment contracts, orders, copyrights, sale of shares, or from the so-called other sources), i.e. through the standard annual PIT with 18% and 32% taxation

flat tax

lump sum on recorded revenues

taxpayers settling lump-sum income indicated in the PIT Act - sale of real estate, cash capital, property rights.

retirees - PIT-OP. They don't have to file the entire tax return. Persons settled by pension authorities will be able to indicate a PIT in PIT-OP, which, after being filled in, can be sent electronically and submitted traditionally (in paper form).

People who are accounted for by the employer cannot use the option of donating 1% to a selected Public Benefit Organization. Such a possibility exists only if they decide to fill in the PIT on their own.

Thanks to everyone who decided to help in this way!

Join the fight for little hearts

Source: https://www.podatki.gov.pl/pit/twoj-e-pit/jak-przekazac-1-podatku-w-usludze-twoj-e-pit/